If you’re a professor at the University of Saskatchewan looking to understand your pension plan better, you’ve come to the right place! I created this guide to help break down what your pension plan offers and how you can get the most out of it.

The Academic Money Purchase Plan—What Is It?

The Academic Money Purchase Plan is the name of your pension plan as a professor at the University of Saskatchewan. The first thing you want to understand is the matching program—you’ll put 8.5% of your income into the plan, and the UofS will match that same percentage. That’s a lot to match, which makes this pension plan a good one. The government gives you a total of 18% to put into a pension plan, which means you’ve now contributed a total of 17%. As you can see, that means you still have 1% left to contribute. You can make the most out of that contribution room by considering your income and tax bracket.

Investment Options Within the Academic Money Purchase Plan

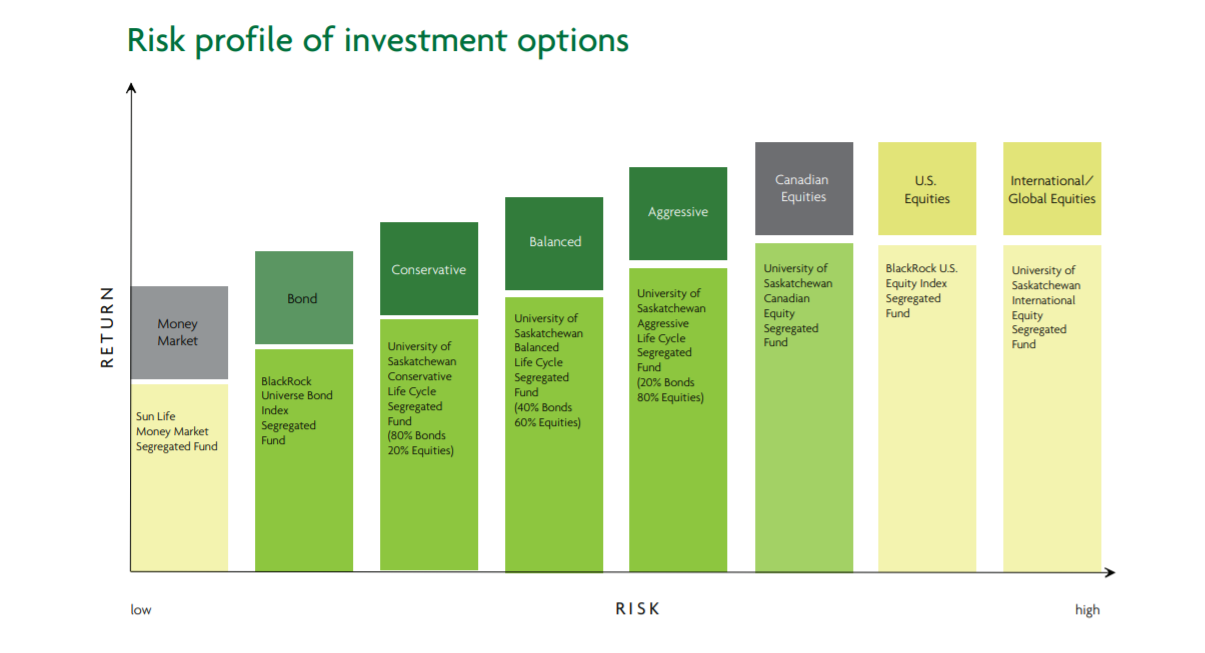

When you join the Academic Money Purchase Plan, you’re added to the Balance Fund option within the plan as a default. However, that’s not your only option. Below are some examples of options you have within your pension plan:

Graph of UofS Academic Money Purchase Plan Options

Choosing the right investment option for your retirement timeframe can make a difference of thousands of dollars. Just because you’re added to the Balance Fund initially doesn’t mean that’s where you should be. Remember, not deciding on where to be within the plan is still a decision. If you’d like a breakdown of each option, this video gives more details.

For more helpful resources regarding The Academic Money Purchase Plan for UofS professors, check out this link.